From Dispute to Harmony: Navigating Real Estate Contract Disputes

- Andre Clark

- Jun 2, 2025

- 17 min read

Why Real Estate Contract Disputes Can Derail Your Property Dreams

Real estate contract disputes arise when buyers, sellers, or other parties disagree about contract terms, fail to meet obligations, or find problems that weren't properly disclosed. These conflicts can delay closings, cost thousands in legal fees, and sometimes kill deals entirely.

Quick Answer - Most Common Real Estate Contract Disputes:

• Breach of contract - Failure to meet deadlines, complete repairs, or fulfill obligations

• Nondisclosure issues - Hidden defects, liens, or property problems not revealed

• Financing problems - Buyer can't secure loans or terms change unexpectedly

• Title defects - Ownership issues, easements, or boundary disputes surface

• Earnest money disputes - Disagreements over deposit refunds when deals fall apart

• Inspection conflicts - Disputes over repair requests or property conditions

According to the National Association of Realtors, 5% of all real estate transactions experience contract-related delays or disputes before closing. In California's high-stakes market, where residential disputes now involve "hundreds of thousands or even millions of dollars," these conflicts can have serious financial consequences.

The good news? Most disputes stem from misunderstandings rather than bad faith. With proper planning, clear contracts, and quick action when problems arise, many conflicts can be resolved without derailing your transaction.

Whether you're dealing with a seller who won't complete agreed repairs, a buyer backing out without valid reasons, or finding title issues during escrow, understanding your options can save both time and money.

1. Understanding Real Estate Contract Disputes at a Glance

When you're buying or selling property, real estate contract disputes can feel overwhelming. Simply put, these conflicts happen when parties disagree about contract terms, fail to meet their obligations, or find problems that weren't properly disclosed upfront.

Think of a real estate contract as a detailed roadmap for your transaction. When someone veers off that path—whether it's a seller who won't make promised repairs or a buyer who misses important deadlines—you've got a potential dispute on your hands.

A breach of contract occurs when one party fails to perform any duty spelled out in the agreement. But here's where it gets interesting: not all breaches are created equal. California courts look at whether the breach is material or minor, and this distinction completely changes your options.

Material Breach | Minor Breach |

Substantially defeats the contract's purpose | Doesn't destroy the contract's essential purpose |

Allows non-breaching party to terminate | Allows damages but not termination |

Example: Seller refuses to transfer title | Example: Closing delayed by 2 days |

Remedies: Rescission, specific performance, damages | Remedies: Limited damages only |

A material breach is like pulling the emergency brake—it can stop the entire deal. If a seller suddenly refuses to transfer clear title or a buyer backs out without valid reasons, you're looking at a material breach. The innocent party can walk away, demand specific performance, or seek significant damages.

A minor breach, on the other hand, is more like a speed bump. Maybe closing gets delayed by a few days due to paperwork issues, or contingency deadlines slip slightly. These situations typically allow for limited damages but don't give you grounds to cancel the entire contract.

Why Disputes Arise

Most real estate contract disputes don't happen because someone's trying to be difficult. They usually stem from three main culprits that trip up even well-intentioned parties.

Ambiguous contract language is probably the biggest troublemaker. When contracts use vague terms like "as-is condition" or "reasonable time," both sides might have completely different ideas about what those phrases mean. One person's "move-in ready" is another person's "needs major work."

Miscommunication runs a close second. Real estate transactions involve a small army of people—buyers, sellers, agents, lenders, inspectors, escrow officers, and sometimes attorneys. With so many voices in the mix, important details can get lost in translation. A simple misunderstanding about repair deadlines or contingency requirements can quickly snowball into a major conflict.

Unmet contingencies round out the top three dispute triggers. Contingencies are supposed to protect you by providing escape routes under specific circumstances. But disagreements often arise over whether contingencies were properly satisfied, waived, or allowed to expire. Picture this: a buyer's financing contingency expires, but they claim they're still waiting for loan approval. Meanwhile, the seller thinks the buyer should forfeit their earnest money. That's a dispute waiting to happen.

The good news? The California Association of Realtors recognized how common these issues are and built mandatory mediation and arbitration clauses into their standard forms. This gives parties structured ways to resolve conflicts without immediately heading to court.

2. Top 10 Triggers of Real Estate Contract Disputes

Knowing what commonly goes wrong in real estate deals can save you from expensive headaches down the road. After handling numerous real estate contract disputes in California, certain patterns emerge that smart buyers and sellers learn to watch for.

Earnest money disputes top the list of conflicts we see. When a deal falls apart, emotions run high and both sides often feel entitled to that deposit. Sellers argue they deserve compensation for taking their property off the market, while buyers insist they followed all the contract rules for getting their money back. These battles can drag on for months if the contract language isn't crystal clear.

Nondisclosure issues create some of the messiest situations. California law requires sellers to reveal known material defects, but what counts as "material" isn't always obvious. When buyers find problems like previous water damage, foundation settling, or pest issues after closing, they may have grounds to pursue the seller for damages or even rescission.

Title defects and boundary disputes can stop deals in their tracks. Nothing kills a closing faster than finding an undisclosed lien, easement, or property line issue. These problems often surface during the title search, leaving everyone scrambling to find solutions before loan commitments expire.

Loan and financing failures create particularly thorny disputes because determining "good faith" effort isn't straightforward. If a buyer's financial situation changes—say they buy a car mid-escrow—sellers may argue the buyer sabotaged their own financing. Meanwhile, buyers facing legitimate loan denials or changed terms may struggle to prove they acted properly.

Appraisal gaps have become increasingly common in competitive markets. When properties appraise below the purchase price, buyers typically want price reductions while sellers resist giving up thousands in equity. These standoffs can turn nasty quickly, especially if neither party wants to walk away.

Inspection and repair disputes probably generate the most daily frustration. Buyers request fixes for everything from leaky faucets to roof repairs, while sellers feel nickeled and dimed. Even when repairs are agreed upon, arguments often arise over completion quality or timeline delays.

Zoning and land use restrictions catch many buyers off guard. Finding you can't convert that garage to a rental unit or add the deck you planned can feel like a bait-and-switch, especially if these limitations weren't clearly disclosed upfront.

Real estate fraud and misrepresentation cases involve more serious misconduct, like lying about rental income, hiding major defects, or misrepresenting property boundaries. These situations often require legal intervention and can result in significant financial consequences.

Escrow and closing delays might seem minor but can trigger bigger problems. When escrow companies make errors or parties miss document deadlines, the resulting delays can cause financing to expire, forcing renegotiation of terms or deal cancellation.

Commercial lease complexities add layers of potential conflict to business property transactions. Issues with tenant estoppel certificates, environmental assessments, or complex financing structures create more opportunities for misunderstandings and disputes.

Real Estate Contract Disputes: Hot-Button Issues Buyers & Sellers Should Spot Early

Two issues deserve special attention because they cause disproportionate problems: undisclosed defects and financing contingency failures.

Undisclosed defects carry serious legal weight in California. Sellers must reveal not just obvious problems but also "latent defects" they know about or reasonably should know about. The clock for pursuing these claims runs longer than many people realize—10 years for latent defects versus 4 years for obvious ones.

Financing contingency failures require buyers to demonstrate good faith effort in securing loans. Simply changing your mind about the purchase won't cut it as grounds for invoking this contingency. However, if loan terms change dramatically through no fault of your own, or if your financial situation changes due to circumstances beyond your control, you may have valid grounds to exit the deal with your earnest money intact.

The key to avoiding these hot-button issues is understanding your obligations upfront and documenting everything as you go. Clear communication and proper documentation can prevent most disputes from escalating into costly legal battles.

3. Key Clauses That Keep Transactions on Track

Think of your real estate contract as a roadmap for your transaction. The right clauses can prevent most real estate contract disputes before they even start, while poorly written agreements practically invite conflict.

Contingency clauses act like your safety net. These provisions give you legitimate ways to exit the deal if certain conditions aren't met. The most common contingencies include financing (typically 21 days), inspection (usually 10 days), and appraisal requirements. Latest research on inspection contingencies shows that clear contingency language prevents most post-inspection disputes by setting specific expectations upfront.

The "time is of the essence" clause can make or break your deal. When this language appears in your contract, deadlines become absolutely critical. Even a one-day delay can constitute material breach. Without this clause, courts typically allow "reasonable" delays, which gives everyone more breathing room but less certainty.

Liquidated damages clauses are like insurance policies for both parties. These provisions predetermine what damages will be if someone breaches the contract, often capping them at 3% of the purchase price. This prevents lengthy court battles over calculating actual damages and gives everyone certainty about their financial exposure.

Alternative Dispute Resolution (ADR) provisions are now standard in most California contracts, and for good reason. These clauses require mediation before anyone can file a lawsuit. About 70% of real estate contract disputes get resolved through ADR rather than court proceedings, saving both time and money for everyone involved.

Specific performance rights give you the power to force completion of the sale rather than just collect money damages. This clause is particularly valuable in California's competitive market, where finding another similar property might be impossible or much more expensive.

Draft Smarter Agreements

Clear, precise language is your best friend when drafting contracts. Vague terms like "seller will make necessary repairs" invite disputes. Instead, specify exactly what repairs are required, to what standard, and by what deadline. The more specific you are upfront, the fewer arguments you'll have later.

California Association of Realtors (CAR) forms are used in over 90% of residential transactions because they're well-tested and legally sound. However, these forms contain legal terms that non-lawyers may not fully understand. Don't assume the boilerplate language automatically addresses your specific situation or concerns.

Attorney review before signing can prevent costly disputes down the road. Having someone with experience in California real estate law review your contract helps catch potential problems early. The Law Office of Andre Clark handles contract review and drafting with experience in California real estate transactions. More info about Contract Law

Detailed disclosure requirements that go beyond minimum legal standards can save everyone headaches later. The more information that's disclosed upfront, the fewer surprises will pop up during escrow. Consider requiring sellers to provide additional documentation about repairs, permits, or property modifications that might not be legally required but could affect the buyer's decision.

4. Prevention Playbook: 7 Practical Steps Before Trouble Starts

Think of preventing real estate contract disputes like getting your car serviced before a long road trip. A little effort upfront can save you from major headaches down the road. Here's your roadmap to keeping transactions smooth from start to finish.

Start with solid due diligence before you even think about signing anything. This means digging into the property's history, checking public records for liens or code violations, and understanding what you're really buying. Don't just trust what you see on the surface—research comparable sales, look up permit history, and check if the neighborhood has any planned developments that could affect property values.

Complete disclosures are your best friend, whether you're buying or selling. Sellers should share everything they know about the property, even if they're not sure it matters legally. That weird smell in the basement? Mention it. The neighbor's dog that barks all night? Worth noting. Buyers should ask specific questions about anything that concerns them. Surprises after closing often turn into expensive disputes.

Professional inspections aren't optional—they're your insurance policy. Yes, they cost money and might slow down your timeline, but finding problems during escrow is much better than finding them after you own the property. For older homes or properties with specific concerns, consider additional inspections for termites, mold, or structural issues.

Title searches need to be thorough, not rushed. Your title company should dig deep for liens, easements, and other issues that could affect your ownership. If problems surface, address them before closing rather than hoping they won't matter later. A clean title is worth the extra time it takes to resolve issues.

Managing escrow professionally keeps everyone on the same page. Choose an escrow company with experience in your type of transaction, and stay in regular contact throughout the process. Provide all required documents quickly and respond promptly to requests for additional information. Good communication with your escrow officer can prevent many last-minute crises.

Open communication between all parties prevents most misunderstandings. Keep buyers, sellers, agents, and service providers informed about important developments. When you have important conversations, follow up with written summaries to make sure everyone understood the same thing. Quick responses to questions or concerns show good faith and keep momentum going.

Documentation is your safety net if disputes do arise. Keep detailed records of all communications, agreements, and changes to the original contract. Save emails, text messages, and notes from phone calls. As one legal source notes, "well-drafted letters alone are often sufficient to resolve disputes short of arbitration or court." Having proper documentation supports these resolution efforts. More info about Why You Need a Real Estate Attorney

Tailoring Protection for Commercial vs Residential Deals

Commercial transactions require extra layers of protection because they're simply more complex. Lease complications can derail deals when existing tenant agreements, estoppel certificates, or rent rolls don't match what was promised. Environmental assessments become crucial—you might need Phase I and possibly Phase II environmental studies before lenders

will approve financing. Lender requirements for commercial properties are typically much stricter, with longer approval processes and more documentation requirements.

Commercial deals also allow longer due diligence periods to accommodate these complex evaluations. What takes a week in residential might take a month in commercial, and that's normal.

Residential transactions follow more predictable patterns. Most deals use standard CAR forms with built-in protections that have been tested in thousands of transactions. Disclosure requirements for residential sellers are clearly defined by law, making it easier to know what must be shared. Financing contingencies for residential loans follow more standardized timelines and requirements, though they're still subject to changing market conditions.

The key difference? Commercial deals require more customized protection for unique situations, while residential transactions can rely more heavily on proven standard practices.

5. Resolution Roadmap: From Demand Letters to Court

When real estate contract disputes arise despite your best prevention efforts, you don't have to panic. California law provides a clear path forward, starting with simple communication and escalating only when necessary.

Start with a Strong Demand Letter

Before calling lawyers or filing lawsuits, a well-written demand letter often does the trick. Think of it as your professional way of saying "let's fix this now before things get messy." The letter should clearly explain what went wrong, what you want done about it, and when you need a response.

Research shows that well-drafted letters alone often resolve disputes without needing arbitration or court proceedings. Your demand letter gains power when it mentions specific consequences like enforcing liquidated damages, recording a lis pendens against the property, or pursuing attorney fees and costs.

A good demand letter isn't angry or threatening—it's factual and firm. It shows you understand your rights and you're serious about protecting them.

Move to Mediation When Talking Isn't Enough

Most California contracts require mediation before you can head to court, and there's good reason for this. Mediation brings in a neutral third party who helps everyone talk through the problem and find solutions.

The best part? Mediation in California typically resolves disputes in just 1-2 days, compared to several months for court cases. It costs much less than litigation, keeps everything confidential, and lets you maintain control over the outcome. Nobody forces a decision on you—you only agree to solutions that work.

Many people worry that mediation shows weakness, but it actually shows you're smart enough to solve problems efficiently. Plus, if mediation doesn't work, you haven't lost anything except a little time and money.

Consider Arbitration for Binding Decisions

When mediation fails and you need someone to make a final decision, arbitration often provides the answer. Unlike mediation, the arbitrator listens to both sides and makes a binding decision enforceable under California Code of Civil Procedure Section 1281.

Arbitration moves faster than court litigation and keeps your business private. The arbitrator can even have real estate experience, so they understand the issues you're facing. However, arbitration decisions are final—you give up most appeal rights in exchange for speed and efficiency.

Head to Court When All Else Fails

Sometimes litigation becomes necessary, especially when the other party won't participate in mediation or arbitration in good faith. Court proceedings involve filing a complaint, serving the defendant, conducting findy, and potentially going to trial.

For smaller disputes under $12,500, California's small claims court offers a faster, simpler option where you can represent yourself. Understanding breach of the contract principles and reviewing Ways to Enforce Real Estate Contracts helps you choose the best strategy for your situation.

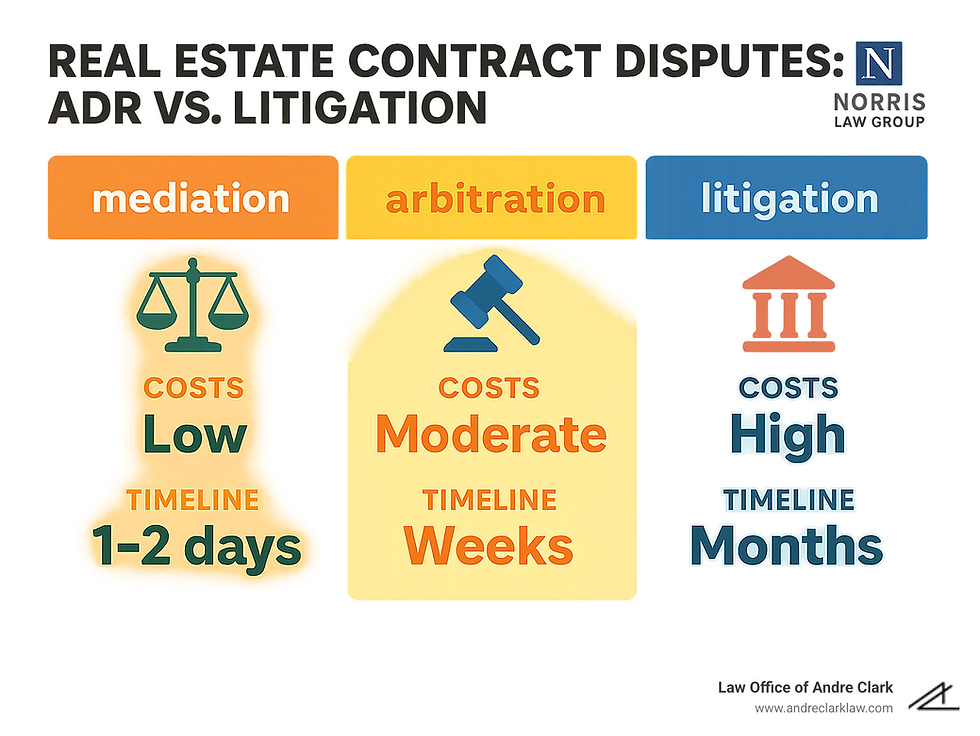

Real Estate Contract Disputes: ADR vs Litigation

Choosing between alternative dispute resolution and litigation isn't just about money—though cost certainly matters. Mediation typically costs a fraction of litigation while resolving disputes in days rather than months. You keep your privacy, preserve relationships, and maintain control over solutions.

Arbitration offers a middle ground with binding decisions under CCP Section 1281, faster timelines than court, and private proceedings. The limited findy process reduces costs, and you can choose arbitrators with real estate experience who understand your industry.

Litigation provides the most comprehensive approach but comes with the highest costs and longest timelines. You get full findy rights, jury trials when appropriate, and broad appeal options. Court proceedings become public record, which some parties prefer for transparency while others see as a drawback.

Over 90% of California residential transactions use CAR forms requiring mediation and arbitration, making these ADR methods standard practice rather than unusual alternatives.

Real Estate Contract Disputes: Damages & Specific Performance Explained

When someone breaches your real estate contract, California law gives you several ways to make things right. The remedy you choose depends on what happened and what outcome you're seeking.

Liquidated damages clauses in many contracts cap your damages at 3% of the purchase price. This provides certainty for everyone—you know exactly what you'll pay or receive if things go wrong. Courts will enforce these clauses as long as they represent a reasonable estimate of actual harm rather than a penalty.

Sometimes money isn't enough, especially when property values have jumped since you signed the contract. Specific performance allows courts to order the breaching party to complete the sale rather than just pay damages. Since every piece of real estate is unique, courts readily grant specific performance in property disputes.

Rescission cancels the entire contract and puts everyone back where they started. This remedy works well when you find fraud, misrepresentation, or material defects that make the property unsuitable for your purposes.

Monetary damages under Civil Code Section 3300 compensate you for losses that flow naturally from the breach. This might include additional housing costs while you find another property, lost profits from delayed business operations, or price differences if replacement property costs more.

Attorney fees become recoverable when your contract includes fee-shifting provisions or specific California statutes apply. Many contracts include clauses allowing the winning party to recover legal costs, which often motivates reasonable settlement discussions.

A lis pendens clouds the property title and prevents transfer while litigation proceeds. This powerful tool often motivates quick settlements because it effectively freezes the property until disputes resolve.

California's four-year statute of limitations for written contract breaches gives you time to pursue remedies, but don't wait too long. The sooner you act, the more options you'll have and the stronger your position becomes.

Frequently Asked Questions about Real Estate Contract Disputes

What constitutes a breach and how fast must I act?

A breach happens when someone fails to do what they promised in the contract. Think of it like breaking a promise - but with legal consequences. Material breaches are the serious ones that defeat the whole purpose of your contract, like a seller refusing to transfer the deed. These big breaches let you walk away from the deal and demand compensation.

Minor breaches are more like hiccups - maybe closing gets delayed by a few days because of paperwork issues. You can still ask for damages to cover your extra costs, but you can't cancel the entire transaction.

Here's the thing about timing: California gives you four years from when the breach happened to file a lawsuit for written contracts. But waiting that long is rarely smart. Evidence disappears, people forget details, and sometimes continuing with the transaction despite knowing about problems can actually waive your rights to complain later.

If you think someone has broken your real estate contract, document everything immediately. Take photos, save emails, and keep records of any conversations. The sooner you act, the more options you'll have. Some remedies, like forcing someone to complete the sale, require you to move quickly or you might lose that right entirely.

How are damages calculated in California property deals?

California courts try to put you in the same position you'd be in if the contract had been completed properly. It's like trying to make you whole again after someone broke their promise to you.

When buyers breach the contract, sellers can usually keep the earnest money if it's properly set up as liquidated damages. They might also recover the difference between your contract price and what they eventually sell for, plus carrying costs like mortgage payments, property taxes, and insurance while they're stuck holding the property.

When sellers breach, buyers can recover the difference between the original contract price and what they end up paying for a replacement property. You might also get compensation for temporary housing costs, lost favorable loan terms, and moving expenses that pile up because of the delay.

But here's an important catch - you can't just sit back and let damages pile up. California requires you to make reasonable efforts to minimize your losses. Sellers need to try to resell the property at fair market value, and buyers should look for comparable replacement homes rather than choosing the most expensive option available.

Courts won't award damages for losses you could have prevented with reasonable effort, and they definitely won't pay for speculative damages that might happen someday. The key is showing that your losses directly resulted from the other party's breach and that you acted reasonably to limit the damage.

Can I get my earnest money back if a contingency fails?

Getting your earnest money back depends on why the contingency failed and whether you followed the rules in your contract. It's not automatic, but you're often protected if you act in good faith.

If you properly remove contingencies within the time limits for legitimate reasons - like getting denied for financing, finding serious problems during inspection, or getting a low appraisal - you should get your deposit back. The key word here is "properly." You need to follow the exact procedures outlined in your contract and meet all deadlines.

But if contingencies expire without being satisfied or removed, buyers typically lose their earnest money unless they can prove the seller somehow prevented them from satisfying the contingency. For example, if a seller refuses to allow reasonable access for inspections, that might protect your deposit.

Good faith matters tremendously. You can't use contingencies as penalty-free escape hatches just because you found a better house or changed your mind. If you're seeking financing, you need to actually apply for loans and work with lenders. If you're doing inspections, you need to conduct them professionally and make reasonable repair requests.

How your earnest money is characterized in the contract also makes a difference. In California, it's commonly structured as liquidated damages, which means sellers can keep it if buyers breach. But if it's just labeled as a deposit, different rules might apply.

The best protection is keeping detailed records of everything you do to satisfy contingencies. If financing falls through, get written rejection letters from lenders. For inspection issues, document problems with photos and get written repair estimates. This documentation becomes crucial if there's a dispute about whether you acted in good faith.

Conclusion

Real estate contract disputes don't have to shatter your property dreams. While 5% of transactions hit bumps along the way, most conflicts can be smoothed out with the right approach and timely guidance.

Think of dispute resolution as a journey with multiple stops. You start with prevention through careful contract drafting and thorough due diligence. If problems still pop up, early identification helps you catch issues before they snowball. When disputes do arise, prompt action keeps small problems from becoming big headaches. Finally, strategic use of resolution methods—from simple demand letters to formal litigation—gives you options that fit your situation.

Whether you're dealing with a seller who won't fix that leaky roof or a buyer trying to back out without valid reasons, knowing your options puts you back in the driver's seat. The research shows that alternative dispute resolution methods successfully resolve about 70% of real estate conflicts faster and cheaper than going to court.

Sometimes a well-written letter does the trick. Other times, you need the full weight of litigation behind you. The key is having someone in your corner who understands which tool works best for your specific situation.

The Law Office of Andre Clark handles real estate disputes throughout California with experience in contract enforcement, breach remedies, and dispute resolution. From crafting demand letters that get results quickly to managing complex litigation when necessary, our client-focused approach protects your interests while seeking practical solutions that actually work.

Don't let contract disputes crush your real estate goals. Whether you need someone to review your contract before you sign, help with an ongoing dispute that's keeping you up at night, or representation in formal proceedings, experienced legal guidance often makes the difference between expensive court battles and successful resolution.

Here's something encouraging: most disputes come from simple misunderstandings rather than people acting in bad faith. With proper preparation, clear communication, and prompt professional help when problems surface, you can steer from dispute to harmony while protecting your investment and reaching your real estate goals.

Every real estate transaction tells a story. Make sure yours has a happy ending.

Comments